Super Channel Indicator for NinjaTrader

Join the growing community of high-performance traders.

Why the Super Channel Indicator Gives You an Edge

Most traders know Bollinger Bands, but few realize their limitations. While they visualize volatility, they often rely on static deviation and lack statistical rigor — leading to false signals and inconsistent accuracy.

The Super Channel Indicator changes that. Built for NinjaTrader 8, it uses mathematically sound, statistically significant formulas to define its dynamic upper and lower bands. This results in a far more reliable framework that filters out noise, adapts to volatility in real time, and isolates only the market moves that truly matter.

By grounding its calculations in real statistical probability, the Super Channel delivers high-confidence trade zones and adapts instantly to changing market conditions — highlighting opportunities that traditional volatility bands often miss.

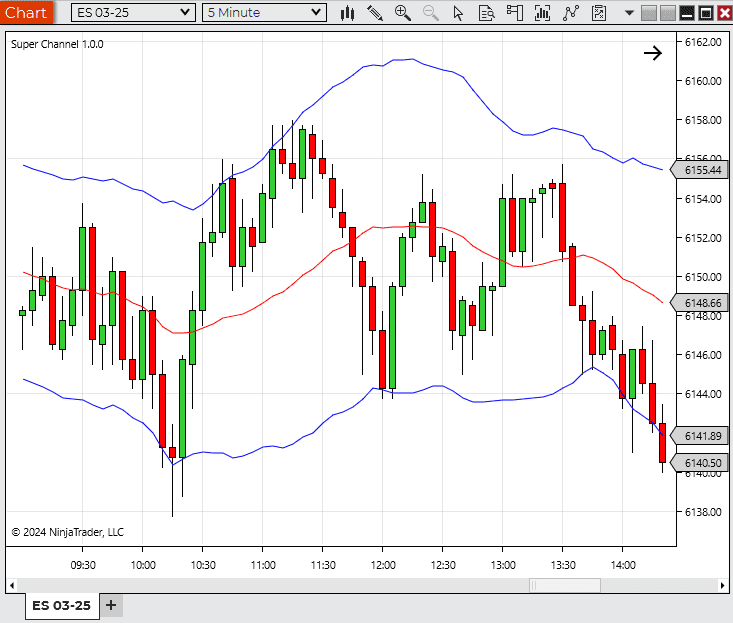

The Super Channel Indicator adapts dynamically to market conditions with statistically significant calculations, offering clearer guidance than traditional Bollinger Bands.

Example: Filter out false signals and trade only where probability favors you.

Example: Stay aligned with dynamic market shifts instead of relying on static bands.

Our custom Super Channel Indicator reveals statistically reliable overbought and oversold regions, giving you a sharper framework for trade timing and market analysis.

See Market Structure Clearly with the Super Channel Indicator

Traditional Bollinger Bands show volatility — but they don’t quantify it with statistical integrity. The Super Channel Indicator builds on this concept using real probability-based algorithms that adapt dynamically to price movement.

The result is a statistically driven view of market structure, allowing you to identify true overbought and oversold conditions while filtering out meaningless fluctuations.

This makes it easier to:

-

Pinpoint zones where price action statistically tends to reverse

-

Confirm volatility-driven entries with real mathematical weight

-

Trade in alignment with statistically validated probabilities

On the left, a standard Bollinger Band shows generic volatility zones. On the right, the Super Channel Indicator applies statistically significant calculations that adapt to real market conditions — revealing high-probability trade zones with far greater precision.

Statistical Precision

Channels are built with mathematically sound formulas, filtering out false signals and noise.

Adaptive Volatility

The Super Channel automatically adjusts to changing conditions, staying aligned with real market flow.

Sharper Trade Timing

Spot statistically reliable overbought and oversold levels for higher-confidence entries and exits.

This is why traders are upgrading to the Super Channel Indicator — delivering statistically reliable trade zones, adaptive volatility tracking, and confidence you can count on.

Why Traders Choose the Super Channel Indicator

Statistically Significant

Channels are based on proven probability formulas, giving more reliable signals than standard deviation bands.

Adaptive Response

The Super Channel automatically adjusts to market volatility, keeping you aligned with real-time conditions.

Sharper Entries

Pinpoint statistically valid overbought and oversold zones for precise trade timing.

Noise Reduction

Filter out false signals and focus only on meaningful market shifts backed by data.

Universal Application

Use across any NinjaTrader instrument — futures, forex, stocks, or crypto — with confidence.

Trade with Confidence

Back your strategy with statistically grounded insights for stronger, faster decisions.

How Traders Use the Super Channel Indicator

1. Add to Your Chart

Drop the Super Channel onto any NinjaTrader chart — works with all instruments and timeframes.

2. See Statistical Bands

View mathematically significant channels that adapt dynamically to market volatility.

3. Identify Key Zones

Spot statistically reliable overbought and oversold regions with far greater precision than Bollinger Bands.

4. Trade With Confidence

Filter out noise, reduce false signals, and execute trades with a clear, probability-backed framework.

Super Channel plots dynamic price channels to highlight trend direction, momentum, and high-probability interaction zones.

Frequently Asked Questions (FAQ)

What is the Super Channel indicator?

Super Channel is a trend-based indicator that plots dynamic upper and lower price channels, helping traders identify trend direction, momentum, and key interaction zones.

How is Super Channel different from traditional channels?

Unlike static or manually drawn channels, Super Channel automatically adapts to price movement and volatility, keeping the channel aligned with the current market structure.

What markets does Super Channel work on?

Super Channel can be used on any market, including stocks, futures, forex, and cryptocurrencies, across all timeframes.

Does the Super Channel indicator repaint?

No. Super Channel does not repaint or rely on hindsight signals. Once the channel values are plotted, they remain fixed.

Who is Super Channel best suited for?

Super Channel is suitable for traders of all experience levels who want clear trend structure and objective channel boundaries.

How can Super Channel be used in trading?

Traders commonly use Super Channel to trade trend continuation, identify pullbacks, set dynamic targets, and manage risk using channel boundaries.

Can Super Channel be used with other indicators or strategies?

Yes. Super Channel works well alongside momentum, trend, and order flow indicators, and can be incorporated into automated or discretionary strategies.

Is training or support included?

Yes. Your purchase includes setup guidance and access to support resources to help you configure and use Super Channel effectively.

Are results guaranteed?

No. Trading involves risk, and results vary based on market conditions and execution. Super Channel is a tool for structure and clarity, not guaranteed profits.

Reviews