NinjaTrader Volumetric Bars Indicator

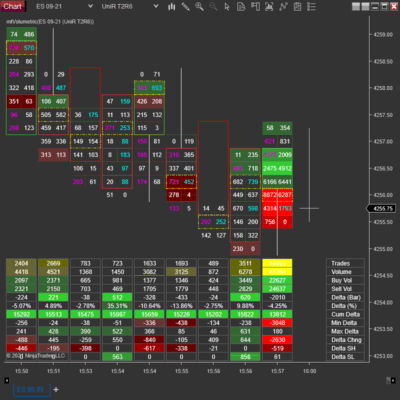

The NinjaTrader Volumetric Bars Indicator enhances trading analysis by calculating and displaying bid and ask volumes at each price level across various bar types. It offers comprehensive statistics, including volume, delta, and cumulative delta, and is compatible with Tick Replay mode and BloodHound (real-time only).

$199.95

(Per license)

Join the growing community of high-performance traders.

Why NinjaTrader Volumetric Bars Give You an Edge

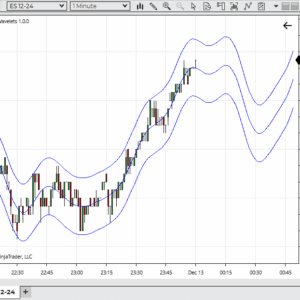

Most charts show surface-level movement — price going up or down — but they don’t tell you the story behind that movement. Our custom NinjaTrader Volumetric Bars dig deeper, breaking down every candle into bid vs. ask volume so you can see exactly where buying or selling pressure stepped in.

This deeper insight reveals the true order flow driving price action. By analyzing volume imbalances, absorption, and exhaustion within each bar, Volumetric Bars uncover what traditional charts leave hidden — giving traders a powerful view of market intent and momentum before the move even begins.

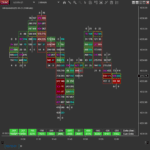

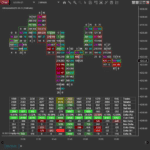

Our custom NinjaTrader Volumetric Bars reveal hidden order flow inside each candle, giving you sharper insight into market structure and trader activity.

Example: Spot absorption or exhaustion before a reversal even starts.

Example: Identify imbalances, trapped traders, and breakout zones.

Our NinjaTrader Volumetric Bars transform raw price action into actionable order flow insight — giving you sharper entries, stronger confidence, and a competitive edge in fast-moving markets.

See the Market Differently with NinjaTrader Volumetric Bars

Standard candlestick charts only tell you what price is doing — not why. The NinjaTrader Volumetric Bars uncover that missing layer by exposing the real-time interaction between buyers and sellers within each bar.

Each candle becomes a map of market intent, showing exactly who dominated each price level. This gives you a sharper understanding of momentum shifts, absorption, and reversals — so you can stay aligned with real order flow instead of reacting to delayed price signals.

The result? Faster recognition of turning points, stronger confirmation of trends, and higher-confidence trades.

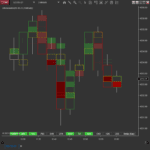

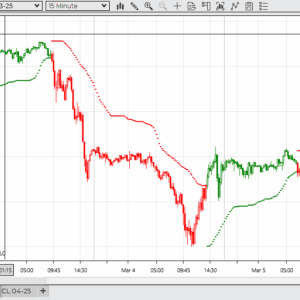

On the left, a standard candlestick chart shows only raw price movement. On the right, NinjaTrader Volumetric Bars expose bid/ask volume inside each candle — revealing the hidden order flow that drives market moves.

Order Flow Transparency

Break down each bar by bid vs. ask volume to see who controls the market.

Footprint-Style Clarity

Expose imbalances, absorption, and trapped traders directly on your chart.

Actionable Market Insight

Identify high-probability trade zones with stronger confidence and precision.

This is why traders are switching to our professional-grade Round Number Bars — revealing critical price levels, clear reactions, and precision you can rely on.

Why Traders Choose Our NinjaTrader Volumetric Bars

Order Flow Insight

See the bid vs. ask volume inside every bar — revealing who’s in control, buyers or sellers.

Footprint-Style Clarity

Uncover imbalances, absorption, and exhaustion directly on your NinjaTrader charts.

Spot Imbalances

Identify when aggressive buyers or sellers overwhelm the other side at key price levels.

Actionable Trade Signals

Pinpoint breakout fuel, reversals, and hidden shifts in momentum with precision.

Flexible Across Markets

Works with any NinjaTrader instrument or bar type — futures, forex, stocks, or crypto.

Stronger Confidence

Turn raw price action into clear order flow intelligence for smarter, faster decisions.

How Traders Use NinjaTrader Volumetric Bars

1. Apply to Any Chart

Add Volumetric Bars to your NinjaTrader chart — works with any bar type, market, or timeframe.

2. Reveal Order Flow

Break down each candle into bid vs. ask volume to see the true balance of buyers and sellers.

3. Spot Imbalances

Identify absorption, exhaustion, and aggressive buying or selling before major moves unfold.

4. Trade With Confidence

Use precise order flow insights to sharpen entries, exits, and overall market timing.

Volumetric Bars reveal where buyers and sellers are active within each candle, helping you spot imbalances, absorption, and true market participation.

Frequently Asked Questions (FAQ)

What are Volumetric Bars?

Volumetric Bars display detailed volume and order flow information within each bar, including bid and ask volume at each price level, allowing traders to analyze buying and selling pressure in depth.

How are Volumetric Bars different from standard candles?

Unlike standard candles, Volumetric Bars show how volume is distributed inside the bar rather than just open, high, low, and close. This reveals imbalances, absorption, and aggressive participation that are otherwise hidden.

What markets can Volumetric Bars be used on?

Volumetric Bars are best suited for futures markets and other instruments that provide reliable bid and ask volume data, such as ES, NQ, RTY, and other liquid contracts.

Do Volumetric Bars repaint?

No. Once a Volumetric Bar is completed, it does not repaint or change. All volume data is calculated in real time from executed trades.

Who are Volumetric Bars best suited for?

Volumetric Bars are best suited for intermediate to advanced traders who want deeper insight into order flow and market participation.

Can Volumetric Bars be used with indicators and strategies?

Yes. Volumetric Bars can be combined with most indicators and automated strategies to enhance trade context and decision-making.

Do Volumetric Bars require a specific data feed?

Yes. Volumetric Bars require a high-quality data feed that provides accurate bid and ask volume in order to display order flow correctly.

Is training or support included?

Yes. Your purchase includes setup guidance and access to support resources to help you configure and interpret Volumetric Bars effectively.

Are results guaranteed?

No. Trading involves risk, and results depend on market conditions, configuration, and execution. Volumetric Bars provide insight into order flow, not guaranteed profits.

Reviews