Delta Suite for NinjaTrader

Join the growing community of high-performance traders.

Why the Delta Suite Indicator Helps You Trade Smarter

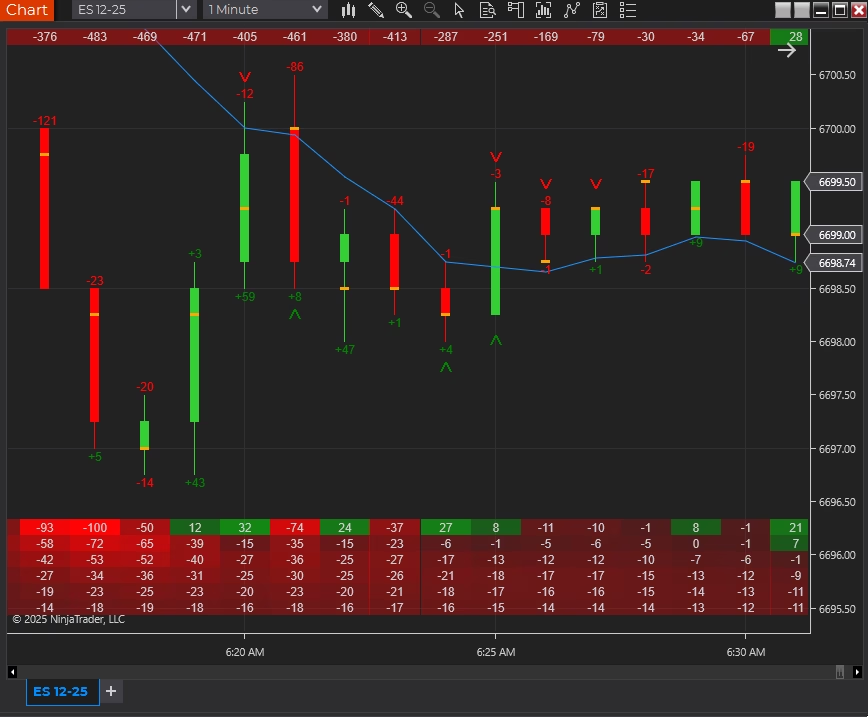

The Delta Suite Indicator goes beyond price action by revealing the real battle between buyers and sellers. It tracks delta, order flow, and volume distribution in real time, giving you a clear view of where market pressure is building or fading.

By combining delta analysis with divergence detection and point of control tracking, the Delta Suite highlights trend reversals, confirms continuation setups, and uncovers hidden imbalances — insights that price alone can’t provide.

The Delta Suite Indicator reveals real-time order flow, delta shifts, and volume imbalances — giving traders an edge by exposing buying and selling pressure hidden behind price action.

Example: Detect hidden selling when price makes new highs with weak delta.

Example: Spot potential reversals when price climbs but delta fails to confirm.

The Delta Suite Indicator combines delta, order flow, and divergence insights to give traders an edge in anticipating moves with clarity — helping you trade based on real market intent, not guesswork.

See Market Pressure and Trade Opportunities Clearly with the Delta Suite Indicator

Most indicators only reflect price action — but the Delta Suite Indicator goes deeper by exposing the hidden battle between buyers and sellers. It tracks delta shifts, bid/ask volume, and divergence signals in real time to show where true market pressure lies.

When delta diverges from price, the indicator highlights areas where momentum is weakening or hidden continuation is forming — giving traders insights before price alone reveals the shift.

The result? A forward-looking tool that combines order flow analysis, delta tracking, and divergence detection, delivering cleaner signals, earlier warnings, and stronger confidence in identifying high-probability setups.

Before: price-only charts leave you guessing about market strength. After: the Delta Suite Indicator uncovers hidden buying and selling pressure, showing traders where the market is truly headed.

Delta & Order Flow

Track bid/ask volume and delta shifts to reveal hidden buying and selling pressure in real time.

Divergence Detection

Automatically spots regular and hidden divergences between price and delta for early trend signals.

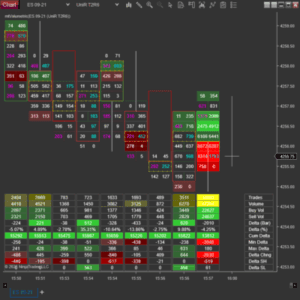

Volume Profile & POC

Identify high-volume nodes and point of control levels to uncover where the market is most active.

This is why traders are choosing the Delta Suite Indicator — combining delta, order flow, and volume profile analysis to uncover hidden market strength and make smarter trading decisions.

Why Traders Choose the Delta Suite Indicator

Delta & Order Flow

Track bid/ask volume and delta shifts to uncover hidden buying and selling pressure in real time.

Divergence Detection

Automatically spots regular and hidden divergences between price and delta for early trade signals.

Volume Profile & POC

Identify high-volume nodes and point of control levels to highlight the market’s most active zones.

Delta Extremes

Monitor maximum and minimum delta shifts to detect potential exhaustion points in market moves.

Real-Time Precision

Get instant updates as new trades hit the tape, ensuring your analysis adapts as the market moves.

Trade with Confidence

Leverage order flow, volume, and delta insights to reduce guesswork and sharpen decision-making.

How Traders Use the Delta Suite Indicator

1. Add to Your Chart

Apply the Delta Suite Indicator to any NinjaTrader chart — works seamlessly across futures, forex, stocks, and crypto.

2. Monitor Order Flow

Track bid/ask volume and delta shifts in real time to reveal hidden buying and selling pressure under the surface.

3. Spot Divergences

Automatically detect both regular and hidden divergences between price and delta for powerful early trade signals.

4. Confirm with Volume Profile

Identify high-volume nodes and point of control levels to align trades with where the market is truly active.

Delta Suite plots per-bar delta, user-defined EMA smoothing on delta, and cumulative delta to reveal real buying and selling pressure in real time.

Frequently Asked Questions (FAQ)

What is the Delta Suite indicator?

Delta Suite is an order flow indicator that displays bar-by-bar delta, user-defined exponential moving averages (EMAs) applied to delta, and cumulative delta to help traders analyze buying and selling pressure.

What is bar-by-bar delta?

Bar-by-bar delta measures the difference between aggressive buying and selling within each bar, showing whether buyers or sellers were in control during that period.

What is cumulative delta and why is it useful?

Cumulative delta aggregates delta over time, helping traders identify divergence between price and order flow, trend strength, and potential exhaustion or absorption.

How do the delta EMAs work?

Delta Suite allows traders to apply one or more user-defined EMAs directly to delta values, smoothing short-term noise and highlighting shifts in order flow momentum.

What markets can Delta Suite be used on?

Delta Suite is best suited for futures markets and other instruments that provide reliable bid and ask volume data, such as ES, NQ, RTY, and other liquid contracts.

Does the Delta Suite indicator repaint?

No. Delta Suite does not repaint or use hindsight calculations. All delta values and EMAs are calculated in real time and remain fixed once plotted.

Who is Delta Suite best suited for?

Delta Suite is best suited for intermediate to advanced traders who use order flow, footprint, or volume-based analysis to guide their trading decisions.

How can Delta Suite be used in trading?

Traders use Delta Suite to confirm trend direction, identify divergence, spot absorption, and time entries and exits based on shifts in order flow momentum.

Can Delta Suite be used with other indicators or strategies?

Yes. Delta Suite works well alongside price-based charts, trend indicators, and automated strategies to add order flow context.

Does Delta Suite require a specific data feed?

Yes. Delta Suite requires a data feed that provides accurate bid and ask volume in order to calculate delta correctly.

Is training or support included?

Yes. Your purchase includes setup guidance and access to support resources to help you configure and interpret Delta Suite effectively.

Are results guaranteed?

No. Trading involves risk, and results depend on market conditions and execution. Delta Suite provides order flow insight, not guaranteed profits.

Reviews