Mastering Choppy Markets

What Are Choppy Markets?

Choppy markets, also known as sideways or range-bound markets, occur when the price of an asset fluctuates between two levels without a clear upward or downward trend. While these conditions seem unproductive for trend-following strategies, they offer unique opportunities. Traders can capitalize on small, consistent price movements.

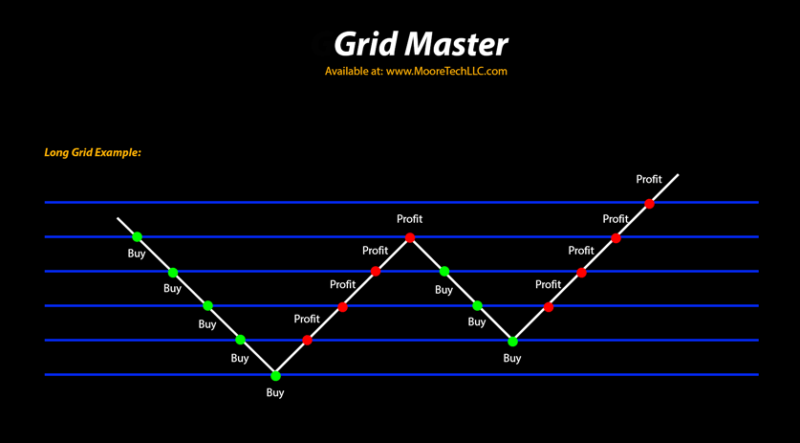

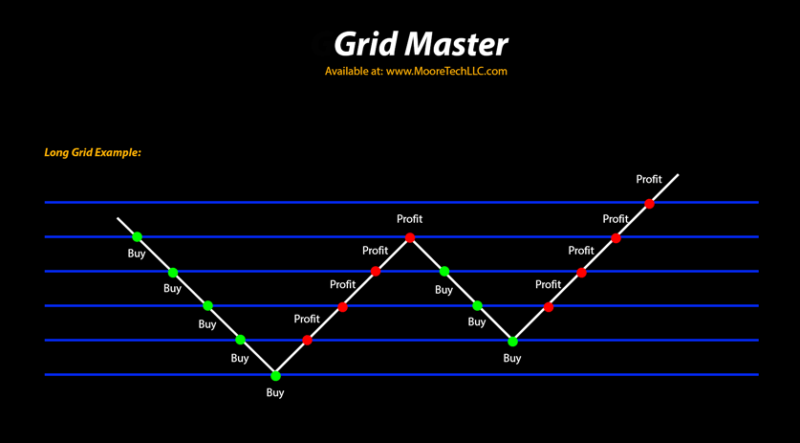

Grid trading is a strategy that excels in sideways markets. It offers a systematic and automated approach to profit from price fluctuations.

What is Grid Trading?

Grid trading involves placing a series of buy and sell orders at predefined price intervals above and below a central level. These orders form a “grid,” enabling traders to buy low and sell high repeatedly as the market moves.

Example: If the current price of an asset is $100, you might set:

- Buy orders at $95, $90, $85, etc.

- Sell orders at $105, $110, $115, etc.

As prices fluctuate, the strategy automatically buys at lower levels and sells at higher levels, capturing profits within the range.

Why Grid Trading Excels in Choppy Markets

- High Frequency of Trades: Range-bound movement creates repeated buy/sell opportunities.

- Low Market Direction Dependence: Unlike trend strategies, grid trading thrives in sideways markets.

- Steady Profit Potential: Small, repeated wins can accumulate significantly over time.

Step-by-Step Guide to Setting Up Grid Trading

1. Choose a Suitable Market: Look for choppy markets with low volatility and clear support/resistance levels.

2. Define Your Grid Parameters:

- Grid Spacing: Price intervals for orders (e.g., every $5 or $10).

- Grid Size: Number of levels above/below the central price.

- Lot Size: Trade size per level, aligned with risk tolerance.

3. Automate with Grid Master: Use a NinjaTrader add-on like Grid Master to execute trades automatically.

4. Monitor and Adjust: Regularly review your grid to adapt to volatility shifts.

Pros and Cons of Grid Trading

Pros:

- Works best in non-trending markets.

- Generates consistent profits in sideways ranges.

- Automation reduces constant monitoring.

Cons:

- Less effective in highly volatile or trending conditions.

- Requires precise setup to avoid overtrading or drawdowns.

How Grid Master Can Help

Grid Master is a powerful market maker tool that simplifies grid trading for all experience levels. With its intuitive interface and advanced customization, it allows you to:

- Automate order placement and execution.

- Adapt your grid strategy for sideways or trending markets.

- Fine-tune parameters for maximum profitability and risk control.

By leveraging Grid Master, traders can focus on strategy while automation handles execution.

Tips for Successful Grid Trading

- Start Small: Practice with demo accounts or small sizes first.

- Set Clear Limits: Avoid stretching your grid too far.

- Monitor Conditions: Be ready to pause when markets trend strongly.

- Use Risk Management: Always set stops and profit targets.

Profit from Choppy Markets with Confidence

Grid trading is a proven method for capturing profits in range-bound markets. It offers a systematic approach to turning small fluctuations into steady returns. Tools like Grid Master help automate your strategy and reduce manual work — allowing you to focus on growing your trading portfolio.

Start mastering grid trading today and unlock the potential of sideways markets!

0 Comments