Your cart is currently empty!

Mastering Choppy Markets

What Are Choppy Markets?

Choppy markets are also known as sideways or range-bound markets. They occur when the price of an asset fluctuates between two levels. There is no clear upward or downward trend. While these conditions seem unproductive for trend-following strategies, they offer unique opportunities. Traders can capitalize on small, consistent price movements.

Grid trading is a strategy that excels in sideways markets. It offers a systematic and automated approach to profit from price fluctuations.

What is Grid Trading

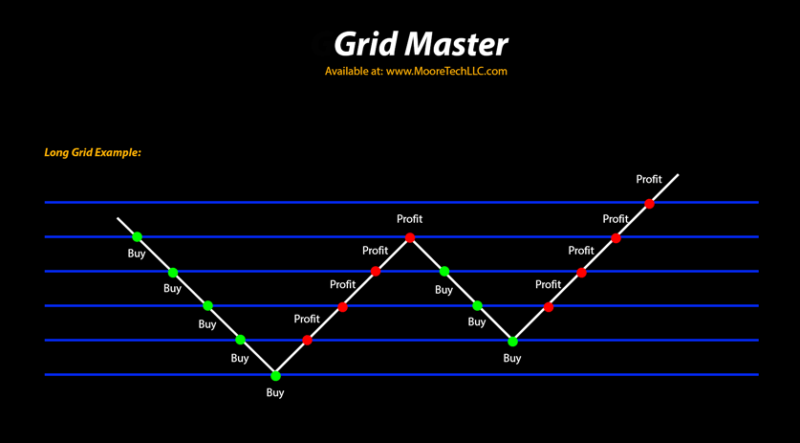

Grid trading involves placing a series of buy and sell orders. These are set at predefined price intervals above and below a central level. These orders form a “grid,” enabling traders to buy low and sell high repeatedly as the market moves.

For example:

- If the current price of an asset is $100, you set up:

- Buy orders at $95, $90, $85, etc.

- Sell orders at $105, $110, $115, etc.

- Buy orders at $95, $90, $85, etc.

- Sell orders at $105, $110, $115, etc.

- High Frequency of Trades: The consistent price movement within a range provides many opportunities to execute buy and sell orders.

- Low Market Direction Dependence: Unlike trend-following strategies, grid trading thrives in non-directional markets.

- Steady Profit Potential: Small, repeated profits can accumulate significantly over time.

- Grid Spacing: Determine the price intervals for placing buy and sell orders (e.g., every $5 or $10).

- Grid Size: Decide how many levels above and below the central price to include.

- Lot Size: Set the amount to trade at each level based on your risk tolerance.

- Ideal for non-trending markets.

- Generates consistent profits in choppy markets.

- Reduces the need for constant market monitoring through automation.

- Less effective in highly volatile or trending markets.

- Requires careful parameter setup to avoid overtrading or excessive drawdowns.

- Automate order placement and execution.

- Adapt your grid strategy to both sideways and trending markets.

- Fine-tune parameters for maximum profitability and risk management.

- Start Small: Test your strategy on a demo account or with small trade sizes to understand its mechanics.

- Set Clear Limits: Avoid overextending your grid to minimize risks in case of unexpected market trends.

- Monitor Market Conditions: Sideways markets can quickly shift into trending markets—be ready to adjust or pause your grid.

- Use Risk Management Tools: Always define stop-loss and take-profit levels to protect your capital.

As prices fluctuate, the strategy automatically buys at lower levels and sells at higher levels, capturing profits within the range.

Why Grid Trading Excels in Choppy Markets

Grid trading is particularly effective in sideways markets because:

Step-by-Step Guide to Setting Up Grid Trading

Choose a Suitable Market:

Choppy markets with low volatility and well-defined support and resistance levels are ideal.

Define Your Grid Parameters:

Set Up Automation with Grid Master:

Use a tool like Grid Master to automate the process. This allows the system to continuously monitor the market. It also executes trades based on your predefined rules.

Monitor and Adjust:

Regularly review market conditions. Adjust your grid parameters as necessary. Ensure they align with changing volatility and price ranges.

Pros and Cons of Grid Trading

Pros:

Cons:

How Grid Master Can Help

Grid Master is a powerful market maker tool that simplifies grid trading for traders of all experience levels. With its intuitive interface and advanced customization options, Grid Master lets you:

By leveraging Grid Master, traders can focus on strategic decision-making while it handles the heavy lifting.

Tips for Successful Grid Trading

Profit from Choppy Markets with Confidence

Grid trading is a proven method for capturing profits in range-bound markets. It offers traders a systematic approach to turning small price fluctuations into steady returns. Tools like Grid Master help you automate your strategy. They minimize manual intervention. You can focus on growing your trading portfolio.

Start mastering the art of grid trading today and unlock the potential of sideways markets!

Ready to take your trading to the next level?

Download a FREE 14-Day Trial of Grid Master!